Top 10 Payroll Outsourcing Companies in the Philippines

Let’s face it managing payroll isn’t anyone’s idea of a good time. From working around tax rules to calculating OT, handling payroll can feel exhausting and time consuming. That’s why more and more businesses are turning to payroll outsourcing. And in a country like the Philippines, where payroll regulations are as dynamic as your workforce, choosing the right payroll outsourcing partner is crucial.

In this blog, we break down the top payroll outsourcing companies in the Philippines, highlight the benefits of payroll outsourcing, and help you streamline your payroll and find an outsourcing provider that fits your business, whether you’re running a lean start-up or a large enterprise.

The Benefits of Payroll Outsourcing Companies in the Philippines

Outsourcing your payroll operations to the Philippines isn’t just a trend, it’s a strategic move that helps companies improve compliance, cut costs, and boost efficiency. The country offers a powerful mix of skilled payroll professionals, a cost-effective labour market, and a well-established BPO infrastructure.

Whether you’re a small business or a multinational, here’s why outsourcing payroll services in the Philippines makes sense:

1.Significant Operational Cost Savings

The cost of living in the Philippines is lower than in the US, Europe, or even some parts of Asia. This means businesses can enjoy competitive payroll outsourcing rates without sacrificing service quality.

No need for physical office space, infrastructure, or in-house HR teams. You save on wages, benefits, and admin overhead, freeing up budget for other core functions.

2.Access to Skilled Payroll Professionals

When you outsource payroll to the Philippines, you’re tapping into a workforce that’s not only English-proficient but also experienced in global payroll practices.

From calculating payslips to managing taxes and statutory deductions, Filipino payroll experts are trained to handle complex, multi-country operations efficiently.

3. Accuracy and Efficiency

Payroll requires precision and even one small mistake can lead to compliance issues or unhappy employees.

Outsourced payroll teams in the Philippines rely on cloud-based payroll systems, automated tools, and mobile-friendly platforms to deliver error-free, on-time payroll processing every cycle.

4. Round-the-Clock Support and Flexibility

The BPO industry in the Philippines is built on 24/7 service delivery. That means your remote payroll team can process salaries, respond to queries, and resolve issues across time zones—perfect for distributed or global teams.

Plus, most providers offer seamless digital collaboration through chat, email, and project management tools.

5. Scalable and Future-Ready

Whether you’re just entering the Philippines or scaling across Southeast Asia, payroll outsourcing gives you the agility to grow fast—without growing HR admin complexity.

The Philippines is home to a thriving payroll outsourcing industry, trusted by local and global businesses alike. Whether you’re looking for full-service payroll management, compliance support, or scalable solutions for a growing workforce, here are some of the top payroll outsourcing companies in the Philippines worth considering:

1. PeoplesHR

When it comes to payroll outsourcing in the Philippines, PeoplesHR leads the pack with an end-to-end solution built for companies operating in dynamic, multi-location environments. Whether you’re running a team of 10 or scaling past 10,000 employees, PeoplesHR has the infrastructure, automation, and local expertise to deliver error-free payroll—on time, every time.

At PeoplesHR Payroll Outsourcing, the goal is simple: take payroll off your plate so you can focus on business growth.

Why PeoplesHR Stands Out

- Salary disbursement to tax compliance handled with precision and automation

- 100% DOLE-compliant payroll processing with accurate deductions and statutory contributions

- Up to 40% savings on payroll administration costs

- Real-time payslip generation and secure employee self-service access

- Seamless integration with attendance, leave, and HR modules

- Tailored outsourcing services including data entry, system management, and compliance handling

- Built for scalability – supports teams from 100 to 10,000+ employees

- Trusted across regional markets, with deep expertise in the Philippine labour landscape

Who It’s Best For:

Enterprises and fast-growing companies looking for a tech-driven payroll partner that delivers compliance, continuity, and cost savings without compromising accuracy.

2. ADP Philippines

ADP is a globally recognized leader in payroll outsourcing services, with a strong presence in the Philippines. Known for its enterprise-grade capabilities, ADP offers payroll processing that’s backed by decades of compliance expertise, robust technology, and global-standard security protocols.

Their solutions are ideal for large organizations and multinationals looking to centralize and standardize payroll across regions while ensuring compliance with local tax laws and labour codes.

Key Highlights:

- End-to-end automated payroll processing with audit trails

- Robust data security and GDPR-compliant systems

- Employee self-service portals for payslips, tax documents, and leave balances

- Expert support on local payroll compliance and reporting

- Scalable to manage large enterprise needs and regional complexities

Who It’s Best For:

Multinational corporations and large enterprises seeking a global payroll solution with deep technical infrastructure and cross-border compliance capabilities.

3. Omni HR

Omni HR is a fast-growing leader in payroll and HR solutions across Asia, including the Philippines. Built for modern, scaling teams, Omni combines multi-country payroll, local compliance expertise, and a cloud-based platform to simplify payroll operations for companies of all sizes.

Omni HR is ideal for businesses expanding in the Philippines and across APAC that want automated, accurate payroll while staying fully compliant with local tax laws and labor regulations.

Key Highlights:

- Multi-country payroll with automated statutory contributions, tax calculations, and localized reporting.

- Smart workflow automation for approvals, reimbursements, off-cycle runs, and payroll audits.

- Seamless integrations with accounting platforms like Xero and attendance systems.

- Employee self-service portals to access payslips, tax documents, and leave balances.

- Dedicated local support teams and implementation managers.

- Enterprise-ready scalability with easy-to-use, mobile-friendly interface.

Who It’s Best For:

Fast-growing companies in the Philippines and the APAC region that need a modern, unified payroll and HR platform, combining compliance, automation, and multi-country capabilities in one solution.

4. Sprout Solutions

Sprout Solutions is a well-known local provider offering payroll outsourcing services for companies that outsource in the Philippines, with a strong focus on small to mid-sized businesses. Their solutions are built around digitizing payroll and ensuring compliance with local statutory regulations, such as BIR, SSS, Pag-IBIG, and PhilHealth.

Sprout’s entry-level packages like “Payroll Starter” are priced for accessibility, making them a go-to for companies that need a basic, managed payroll service.

Key Highlights:

- Dedicated payroll specialists and managed payroll processing

- ISO 27001:2013 certified for data security

- Localized support and compliance assurance

- Starter packages for businesses with Less than 10 employees

- Integration with their in-house HRIS and attendance modules

Who It’s Best For:

Startups and small businesses in the Philippines that need a basic, local payroll outsourcing option without the need for full HR automation or enterprise-level scalability.

5. D&V Philippines

D&V Philippines is a trusted name in payroll and finance outsourcing, catering to both local firms and international companies with Philippine operations. They specialize in customized, accountant-led payroll solutions, making them a good fit for businesses with specific reporting needs or financial structures.

Their services range from full-service payroll processing to partial support, giving companies flexibility in how much control they retain over internal payroll tasks.

Key Highlights:

- Full-cycle payroll services including salary computation, deductions, and payslip generation

- Compliance with local labor and tax regulations (SSS, BIR, PhilHealth, Pag-IBIG)

- Dedicated teams of accountants and payroll specialists

- Support for partial outsourcing (e.g., just government remittances or reporting)

- BPO-ready support model for foreign-owned or international clients operating in the Philippines

Who It’s Best For:

Foreign-owned companies, SMEs, or accounting-focused organizations looking for hands-on, customizable payroll processing managed by financial professionals.

6. JustPayroll.ph

JustPayroll.ph is a homegrown payroll technology company offering end-to-end payroll processing in the Philippines. With a strong focus on automation, local compliance and complex payroll, JustPayroll.ph combines software with managed services to support HR and finance teams, especially in small to medium enterprises.

Their platform provides tools for payroll, timekeeping, and employee self-service, while their outsourcing arm handles payroll execution, government reporting, and salary disbursements.

Key Highlights:

- Fully managed payroll outsourcing, including payslip generation and government remittance

- BIR, SSS, PhilHealth, Pag-IBIG compliance built into workflows

- Cloud-based payroll software with employee self-service access

- Time and attendance tracking modules included

- Dedicated local support team with domain expertise

Who It’s Best For:

SMEs looking for an all-in-one local payroll solution for accurate and timely payroll with the option to combine software and outsourcing for more control and flexibility.

7. KPMG Philippines (R.G. Manabat & Co.)

KPMG in the Philippines (operating through R.G. Manabat & Co.) provides comprehensive payroll-related services as part of its tax and accounting offerings. They handle a “full range of payroll services”, including computing employee net salaries after taxes and disbursing pay to employees. They assist with statutory filings and remittances (preparing and submitting reports for SSS, PhilHealth, Pag-IBIG, etc.) and ensure compliance with BIR rules, withholding taxes, and labor laws. KPMG combines automated tools (e.g. the global KPMG LINK payroll platform) with expert review, so the process is typically hybrid (automated calculations plus professional oversight). As a Big Four firm, KPMG leverages global best practices and maintains rigorous security.

Key Highlights:

- Payroll Processing: Full payroll management (gross/net computation, deductions) and salary disbursement logistics.

- Compliance: End-to-end support for Filipino regulations (monthly/annual BIR returns, SSS/Pag-IBIG/PhilHealth remittances, 13th-month pay rules).

- Automation: Uses KPMG’s global payroll software (automated reconciliations and audit trails) combined with manual audit checks.

- Features: Likely includes employee self-service portals for payslips and tax forms (by analogy to global KPMG offerings), and seamless integration with KPMG tax/audit services.

- Certifications: Adheres to international standards (ISO/IEC 27001 certified information security systems).

Who It’s Best For:

Corporations and fast-growing businesses that want a tech-enabled payroll partner with global infrastructure and expertise, ensuring error-free processing, regulatory compliance, and data security.

8. PayrollHero

PayrollHero is a tech-first, cloud-based payroll and time-tracking solution built specifically for the Philippine market to outsource their payroll. Known for its selfie-based clock-in, mobile accessibility, and end-to-end automation, it streamlines payroll by integrating attendance, salary computation, and government compliance in a single platform.

Key Highlights:

- Full automation of payroll in the Philippines, attendance, and government forms

- Facial recognition and GPS time-tracking

- Real-time payslips and downloadable BIR/SSS/PhilHealth forms

- Bank integration for salary disbursement

- Mobile-first UX with employee self-service portals

- Hosted on secure AWS infrastructure (ISO 27001, PCI-DSS Level 1)

Who It’s Best For:

SMEs, startups, and distributed teams that want a modern, mobile-first payroll system with complete automation and local compliance.

9. Payreto

Payreto is a specialized BPO partner offering finance operations outsourcing for fintechs, payment firms, and financial service providers. While not a traditional payroll outsourcer, it supports operational workflows like reconciliation, reporting, and merchant onboarding under strict compliance protocols. Its solutions are people-powered but backed by secure tech.

Key Highlights:

- Finance-as-a-Service for P2P, R2R, and reconciliation

- White-label support for payment and fintech firms

- 24/7 scalable teams and customizable reporting

- PCI-DSS Level 1 certified environment

- Hybrid automation with flexible staffing

Who It’s Best For:

Fintechs, remittance firms, and financial services businesses needing outsourced finance operations—not suitable for traditional HR payroll outsourcing.

10. BruntWork

BruntWork is a global outsourcing company offering a range of services, including payroll management, to businesses seeking cost-effective and efficient solutions. With a focus on flexibility and scalability, BruntWork provides tailored payroll services to meet the diverse needs of its clients.

Key Highlights:

- Comprehensive Payroll Services: BruntWork offers end-to-end payroll processing, ensuring accurate and timely salary disbursements, tax calculations, and compliance with local regulations.

- Cost-Effective Solutions: With pricing ranging from $4 to $8 per hour, BruntWork provides affordable payroll services without compromising on quality.

- Flexible Engagement Models: Clients can choose from various engagement models, including part-time and full-time arrangements, to suit their specific requirements.

- Dedicated Support: BruntWork assigns dedicated account managers to each client, ensuring personalized service and prompt resolution of any issues.

- Global Reach: While headquartered in the Philippines, BruntWork serves clients worldwide, leveraging its extensive network of professionals to deliver exceptional payroll services.

Who It’s Best For:

Small to medium-sized enterprises (SMEs) and startups looking for reliable, affordable, and scalable payroll solutions to streamline their operations and ensure compliance with local regulations.

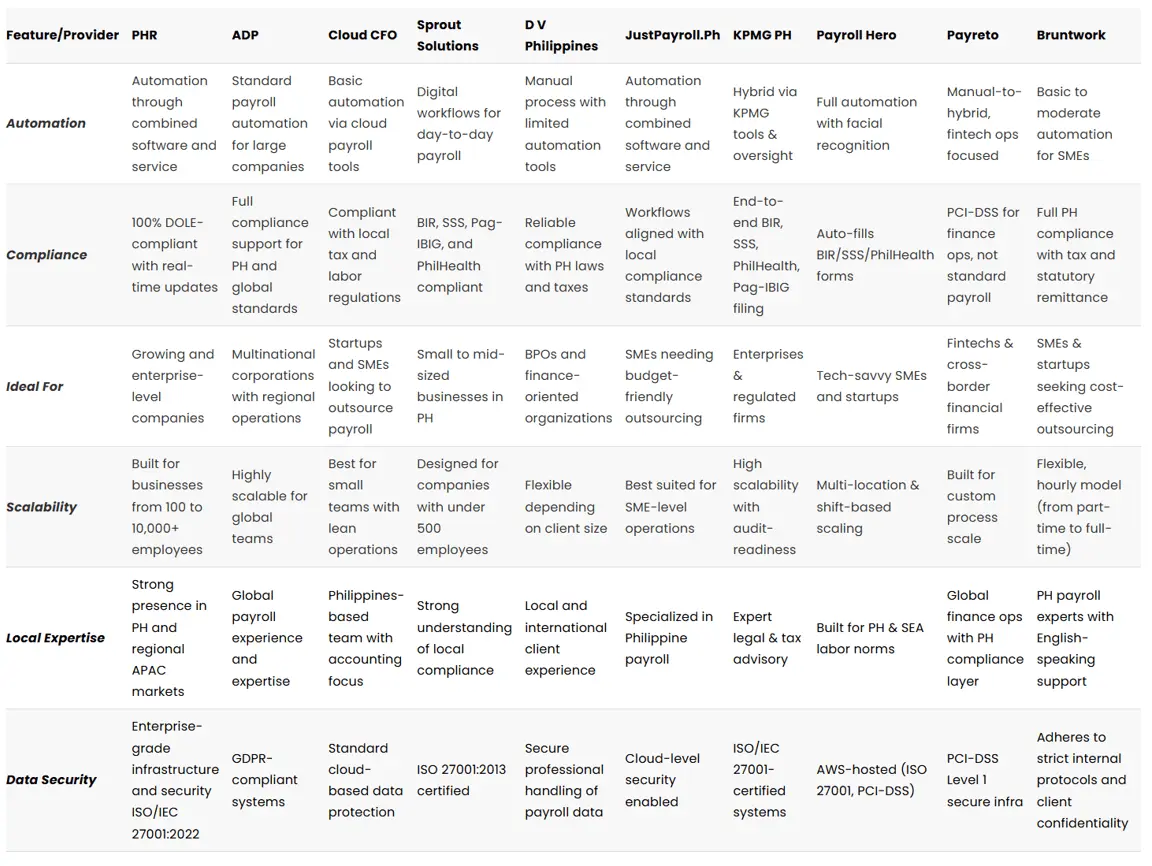

A Quick Comparison of Payroll Outsourcing Services in the Philippines

Choosing the best payroll partner can make or break your HR operations especially when compliance, automation, and scalability are on the line. Below is a side-by-side comparison of the leading payroll outsourcing companies in the Philippines, highlighting how they stack up across key features like automation, employee access, HR integration, and local expertise.

The Future of Payroll is Smarter, Simpler, and Outsourced

The Philippines has firmly positioned itself as a top global destination for HR and payroll outsourcing, offering access to skilled professionals, cost-effective services, and strong regulatory compliance. From lean startups to fast-scaling enterprises, the right payroll partner can streamline operations.

Through this blog, we’ve explored the top payroll outsourcing companies in the Philippines each offering something unique for company’s payroll needs. Some focus on affordability, others on global standardization.

But if you’re looking for a provider that offers full-service outsourcing, powerful automation, HR integration, and local expertise all under one roof PeoplesHR clearly leads the way.

Whether you’re managing 100 employees or 10,000, it’s time to rethink payroll not just as a task but as a strategic function. And with the right partner, that transformation starts today.